All businesses; whether big or small require vehicles to carry on their businesses smoothly and happily. It could be a fleet or one or two vehicles. However, purchasing a vehicle dries up the bank account; especially for small businesses, who often struggle to manage with their limited funds.

Car leasing vs Buying

Business car leasing or business contract hire therefore, seems like a more enticing alternative. In fact, small businesses even enjoy tax deductions on these, if the car has been driven for business purposes at least 50 percent of the time.

However, small business owners are mostly split on whether car leasing is more profitable than buying a vehicle.

A comparison of both will help them make the right decision.

-

The primary difference in buying and leasing is the total amount payable. A car that costs about $30,000 can be leased for a span of three years for almost half the amount.

-

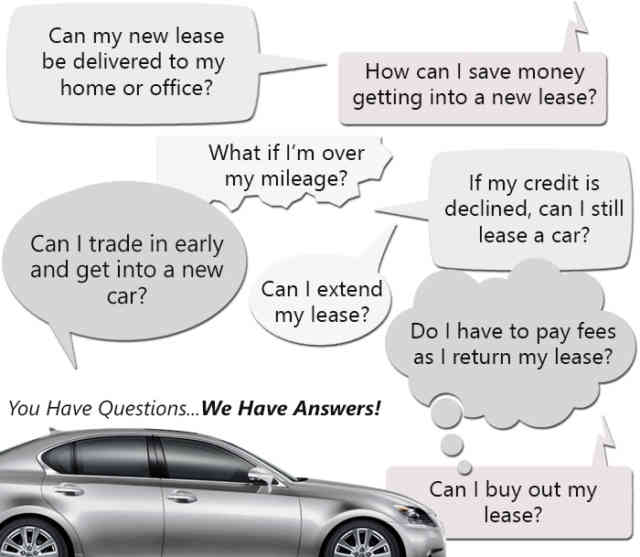

Business car leasing and business contract hire payments often include road tax, repairs and maintenance and insurance costs. Business owners, therefore mostly do not have to bear any additional expenses. The only expense probably payable would be towards driving extra miles beyond the specified limit. On the contrary, when buying a vehicle, repair and maintenance costs are borne by the owner separately.

-

Leasing a vehicle is a great option for people who like change. Leasing period is ideally three years. At the end of the period, the vehicle is returned to the leasing company and a new car lease agreement for a new vehicle is made.

Moreover, depreciation of the vehicle is the least in the first few years. The business can therefore, benefit from the vehicle's best performance in its best years.

-

The wear and tear of the vehicle reduces its resale value. However, this is not so in leased vehicles. The leased car is taken back by the leasing company at the agreed price. Only excessive wear and tear; if any is chargeable.

-

Another difference in business car leasing and buying is the disposition of the vehicle. The profit or loss calculated while disposing a purchased vehicle is taxable as ordinary income. This is due to the depreciation. The same is not true in business car leasing. Profit or loss is not calculated at the time of returning the vehicle to the leasing company.

-

Car leasing payments are completely deductible from taxes whereas only the interest on car loan is deductible on a purchased vehicle. Both purchased and lease vehicles are eligible for depreciation, depending on the kind of car and few other factors. The tax adviser can explain these correctly.

So, car leasing seems like a favorable option for small business owners. Not only can they use a vehicle to fulfill their business needs, but can also enjoy other benefits, as listed above.